My Review: In this Teji Mandi app review, I’ll provide an unbiased assessment based on my experience. I’ve installed the app, signed up for a six-month membership, and used the referral code “nbv0kmad” for a cashback of Rs. 300. So, the net fee I paid was Rs. 594 for six months. Today, I’m here to give you an in-depth Teji Mandi app review, so you can make an informed decision about your investments. Let’s explore the Teji Mandi app and its features.

Note: Teji Mandi is a brand-new online platform designed to help people like you invest in the stock market. In this Teji Mandi app review, we’ll take a closer look at its offerings and performance.

Quick tip: To get started with the Teji Mandi app review, use the Teji Mandi referral code “nbv0kmad” when signing up. This way, you can enjoy the benefits and incentives while exploring the app.

Overview

| Category | Details |

|---|---|

| Platform Type | Online Investment Platform |

| SEBI Certification | Yes |

| App Compatibility | iOS, Android |

| Referral Code | nbv0kmad (Get Rs 300 Cashback) |

| Subscription Fee | 3 Months: ₹597 / 6 Months: ₹894 (after cashback) |

| Minimum Investment | ₹21,000 to ₹25,000 (Varies with stock prices) |

| Supported Brokers | Zerodha, Upstox, 5paisa, and more |

| Languages | English, Hindi |

Beware: While this Teji Mandi app review will highlight its strengths, it’s essential to consider its drawbacks as well. We’ll provide a balanced perspective on the app’s performance.

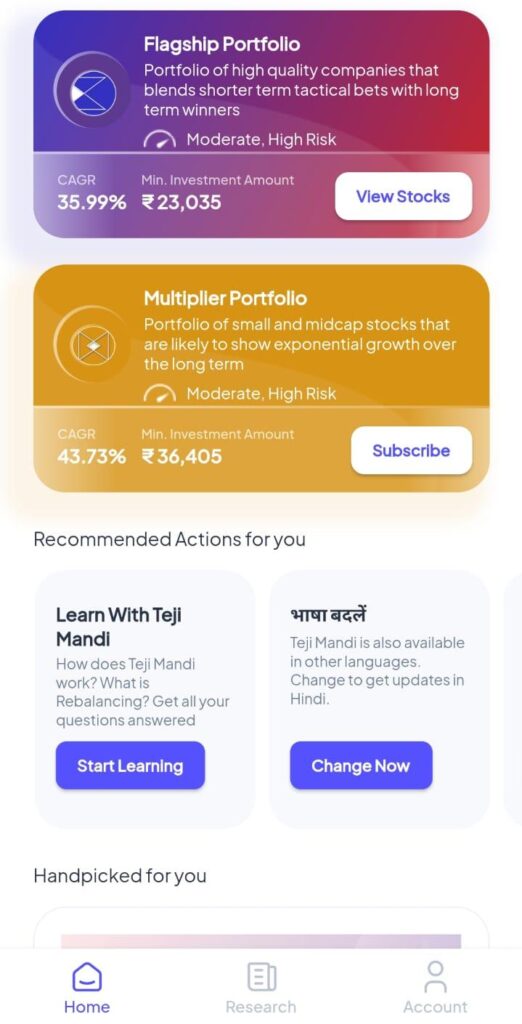

Unique: One of the unique aspects we’ll discuss in this Teji Mandi app review is its approach to creating portfolios. Teji Mandi offers a distinct portfolio of 15 to 25 different stock options, saving you the hassle of selecting stocks individually.

Pros and Cons

| Pros | Cons |

|---|---|

| – SEBI-certified, backed by Motilal Oswal | – Basic dashboard and user interface |

| – Expertly managed portfolios | – Reported occasional app crashes |

| – Guidance on stock selection and timing | – Technical issues (addressed by support) |

| – Monthly SIP and regular rebalancing | |

| – Affordable subscription cost | |

| – Cashback with referral code |

Teji Mandi Portfolio Strategy

The Teji Mandi app follows a strategic investment approach:

- Liquidity Focus: Stocks selected from Nifty 500 for high liquidity.

- Targeted Returns: Aims for consistent returns over time.

- Risk Mitigation: Avoids underperforming stocks and adjusts exposure.

Testimonials

🌟🌟🌟🌟🌟

Great app for beginners! The expert guidance and monthly SIP options have made my investment journey much smoother. Highly recommended. 🌟🌟🌟🌟🌟

— John Doe

🌟🌟🌟🌟

I’ve been using Teji Mandi for a while now. It’s a good platform, but I hope they improve the user interface. 🌟🌟🌟🌟

— Jane Smith

Caution: It’s essential to be prepared for the initial investment when exploring the Teji Mandi app. Depending on stock prices, this Teji Mandi app review will inform you that the minimum investment could range from 21,000 to 25,000 rupees.

Important: When discussing costs in this Teji Mandi app review, we’ll emphasize that there’s a subscription fee for the TejiMandi Flagship portfolio. This fee can be for three or six months, costing 597 or 894 rupees, respectively. However, using the referral code “nbv0kmad” can get you a cashback of Rs 300. It’s a critical point to consider in our Teji Mandi app review, as this cost will affect your overall returns.

Quick tip: The Teji Mandi app handles portfolio rebalancing, alleviating any concerns you might have about managing your investments.

Advantages of Teji mandi

Here’s why you should consider exploring the Teji Mandi app further:

- In this Teji Mandi app review, we’ll highlight that you receive a portfolio of 15 to 20 stocks actively managed by experts, a valuable option for those who lack the time or expertise for individual stock research.

- Teji Mandi provides guidance on stock selection and selling timing, a significant advantage discussed in this Teji Mandi app review.

- The app allows you to set up a monthly investment plan.

- Regular rebalancing and customer support are additional benefits we’ll explore in this Teji Mandi app review.

- The app is backed by Motilal Oswal, a reputable financial institution, adding a layer of trustworthiness.

Drawbacks of Teji mandi

In this Teji Mandi app review, we won’t shy away from discussing its downsides:

- The Teji Mandi app’s dashboard and user interface are quite basic. While improvements are expected, we’ll address this limitation in our Teji Mandi app review.

- Some users have reported crashes and other technical issues. However, contacting their support team can help resolve these concerns, a point we’ll touch upon in this Teji Mandi app review.

New & Latest: The Teji Mandi app is a recent addition to the world of investment platforms, offering a fresh approach to investing in the stock market. In our Teji Mandi app review, we’ll assess how it stacks up against the competition.

Remember: Teji Mandi operates under the guidance of SEBI, India’s financial regulatory authority. This ensures a level of trustworthiness and reliability, a key aspect we’ll explore in this Teji Mandi app review.

How to Use Teji Mandi Referral Code

- Download the Teji Mandi App from the Play Store or App Store.

- Register your profile.

- Choose a subscription plan that suits you.

- When subscribing, use the referral code “nbv0kmad” for a cashback.

Getting Your Cashback: If you provide UPI information, your cashback will be issued automatically. If not, use the ‘Withdraw’ option on the referral screen and enter your bank details.

Terms and Conditions: To begin your investment journey with the Teji Mandi app, you’ll need to download the official app of teji mandi and register with one of the top 10 brokers in India. This Teji Mandi app review will delve into the compatibility and ease of integration with brokers like Zerodha, Upstox, and 5paisa.

Teji Mandi App Review – Final Verdict

After an unbiased Teji Mandi app review, we find that it offers a promising investment platform with expertly managed portfolios and guidance. However, it can benefit from UI improvements to enhance user experience.

Overall Rating: 🌟🌟🌟🌟

If you’re considering entering the world of stock market investments, Teji Mandi is a viable option. Don’t forget to use the referral code ‘nbv0kmad’ to enjoy a cashback incentive. Happy investing!

In conclusion, this Teji Mandi app review aims to offer a balanced perspective. It’s a promising investment platform with strengths and some areas for improvement. If you’re considering exploring the world of stock market investments, Teji Mandi could be a viable option. Don’t forget to use my referral code “nbv0kmad” to get started with a cashback incentive. Happy investing!